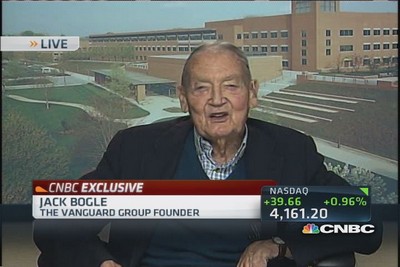

Be prepared for lower returns, says Jack Bogle

Tuesday, 22 Apr 2014 | 3:19 PM ET

CNBC.com

As the Dow Jones industrial average and S&P 500 index flirted with all-time highs on Tuesday, investing legend Jack Bogle told CNBC stocks are a little expensive at current levels—but investors should brace for lower returns.

"The market is probably a little on the high side of fair value, but not enough to make me take an investment action," said the founder of the Vanguard Group, which manages about $2.5 trillion among its various funds, on "Closing Bell."

Bogle said the bulk of first-quarter earnings reported have, so far, actually been valued at 20 times earnings.

"That's a little above the norm, but over the next, say 10 years, or even longer, dividend yields are going to contribute 2 percent to the return and they'll probably grow at the rate of earnings growth, which could be as high as 5 [percent]. So I think something like a 7 percent future return is going to be what people are going to have to accept," Bogle said, adding he expects a long-term return of 9 percent, given the long-term dividend yield is 4.5 percent.

"And the long-term return, of course ... is 9 [percent] because the long-term dividend yield was not 2 percent, but 4.5 percent. So we have to—dividends are very important in the equation as we look at it and we just have to be prepared for lower returns at historical norms."

—By CNBC's Drew Sandholm.

"The market is probably a little on the high side of fair value, but not enough to make me take an investment action," said the founder of the Vanguard Group, which manages about $2.5 trillion among its various funds, on "Closing Bell."

Bogle said the bulk of first-quarter earnings reported have, so far, actually been valued at 20 times earnings.

"That's a little above the norm, but over the next, say 10 years, or even longer, dividend yields are going to contribute 2 percent to the return and they'll probably grow at the rate of earnings growth, which could be as high as 5 [percent]. So I think something like a 7 percent future return is going to be what people are going to have to accept," Bogle said, adding he expects a long-term return of 9 percent, given the long-term dividend yield is 4.5 percent.

"And the long-term return, of course ... is 9 [percent] because the long-term dividend yield was not 2 percent, but 4.5 percent. So we have to—dividends are very important in the equation as we look at it and we just have to be prepared for lower returns at historical norms."

—By CNBC's Drew Sandholm.

No comments:

Post a Comment